BY ODIGIE OKPATAKU

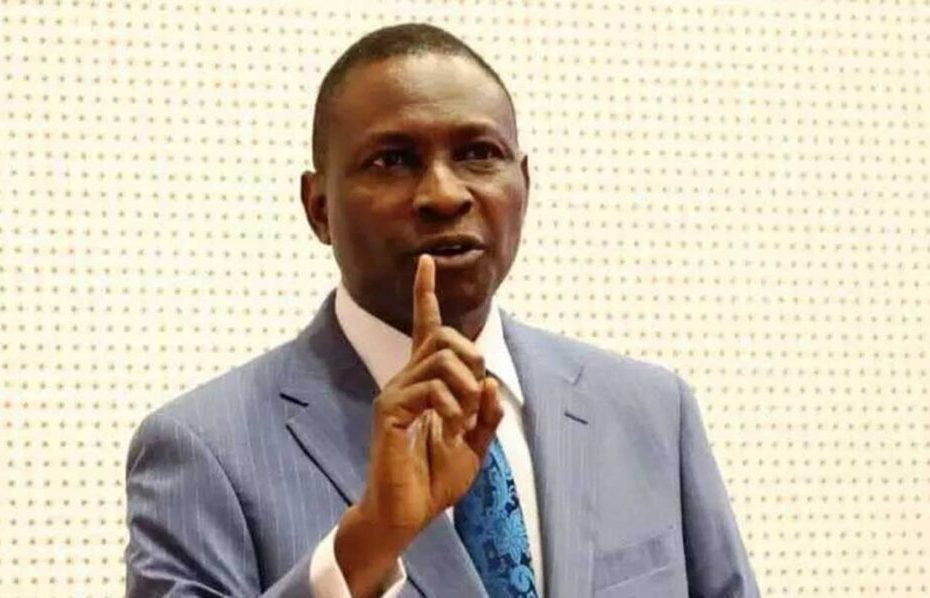

The Chairman of the Economic and Financial Crimes Commission (EFCC), Ola Olukoyede, has called for sweeping reforms across Africa to reduce investment risks and unlock the continent’s economic potential.

Olukoyede made the call on Friday at the EBII Group African Leaders and Partners Forum in Washington DC, United States. His remarks were shared in a statement issued by EFCC spokesperson, Dele Oyewale.

According to him, Africa must embrace “broad-based and radical reforms” to improve its investment climate.

“De-risking Africa requires us to pay attention to reforms to improve the ease of doing business, respect for the rule of law and human capital development. Success in this regard requires strong institutions in view of the challenges that already exist in the agricultural, renewable energy and solid minerals sectors,” he said.

Despite its natural resources and youthful population, he noted, Africa needs integrated reforms to attract sustainable foreign direct investment.

Olukoyede cited the EFCC’s record as an example of institutional reform. He highlighted that the commission, since its establishment 22 years ago, had secured over 13,000 convictions, including 4,111 in 2024 alone.

“There can be no greater incentive to investors than assurance of due process and rule of law. From a background of zero convictions for financial and economic crimes, we have achieved over 13,000 convictions in 22 years of operation,” he stated.

The EFCC chair also detailed the agency’s preventive measures, including the creation of a Department of Fraud Risk Assessment and Control in 2023, which tracks public funds and evaluates contracts. One such evaluation, he said, involved a $50 million Pi-CNG project that delivered 95 per cent of its buses and conversion kits.

He pointed to the commission’s crackdown on fraud, noting the arrest of 792 cybercrime suspects in Lagos in a single operation, the forfeiture of 753 Abuja properties linked to fraud, and probes into cryptocurrency scams such as the Crypto Bridge Exchange case, where investors lost more than $500 million.

Olukoyede added that EFCC’s investigation of Binance and collaborations with global law enforcement bodies like the FBI, the UK’s National Crime Agency and the Canadian Royal Mounted Police demonstrate Nigeria’s commitment to international anti-financial crime efforts.

He stressed that Africa remains a priority for investors worldwide.

“Whether we like it or not, there is an ongoing scramble for Africa, which confirms global expectations of a continent waiting to unleash its potential. However, this time, the scramble is not about territorial influence, as was the case in colonial times. Rather, forward-looking partners who are willing to key into Africa’s vision are already active on the continent, helping to build the foundation of our prosperity,” he said.